SEPA Direct Debit Amendment Solution

Recent research by the Competition and Consumer Protection Commission (CCPC) has indicated that while the majority (81%) of KBC and Ulster Bank current account customers plan to switch to a new current account provider, less than half (44%) have already opened one and among consumers who have already started or completed the process of switching, their biggest challenge was moving direct debits.

In response to this challenge, IT Solutions, has partnered with Lightico, the leading Digital Completion platform, to deliver a SEPA Direct Debit Amendment Solution to help brands speed up Direct Debit change requests, easily and securely, ahead of the KBC and Ulster Bank exits.

Most customers already have direct debits in place with multiple providers (direct debit originators) for common services, including:

- Energy usage (electricity and gas)

- Phone usage

- Mobile phone monthly plans

- Broadband usage

- Refuse collection services

- Loan repayments

- Insurance cover

- Gym membership

A number of direct debit originators have online facilities where their customers can change direct debit details via a secure online portal, others use paper based forms, and some require their customers to contact them by phone.

Because there are a lot of SMS/link scams, we designed the service so only the customer could request the SMS after calling into the brand and would therefore initiate and expect the actual branded SMS with secure link.

As the timeline for the switch from KBC and Ulster Bank gets closer and closer, the likelihood is that thousands of customers will be phoning their direct debit originators due to last minute panic and the resources will not be in place to facilitate this surge in call volumes.

The Solution – Direct Debit Change Made Easy

“From personal experience, I found the process of switching direct debits extremely time consuming. I had to ring over ten brands directly, queuing for up to 30 minutes depending on when I called, just to change my bank details. These brands are already dealing with growth in customer enquiries due to Covid, energy costs, and inflation with fewer staff, so to add an additional volume of calls is really stretching them” according to John Finnegan, Sales Director, IT Solutions.

“We knew there had to be a better way, which was secure, created trust but took a fraction of the time, so we developed a secure cloud based Direct Debit Amendment Solution.

1. When a customer phones their Direct Debit Originator, the brand will now offer them an IVR (Interactive Voice Responses) option, connecting them to a secure cloud solution which will send a branded SMS link to the customer’s mobile phone at the customer’s request.

2. Once the branded SMS message is received, the customer simply follows the simple instructions to change their direct debit details, all fully secured by Lightico’s Encrypted Digital Completion Cloud.

3. Data validation can be provided, ensure that the customer data that the brand receives is clean.

4. Simple to implement, can be integrated with back end systems if required.

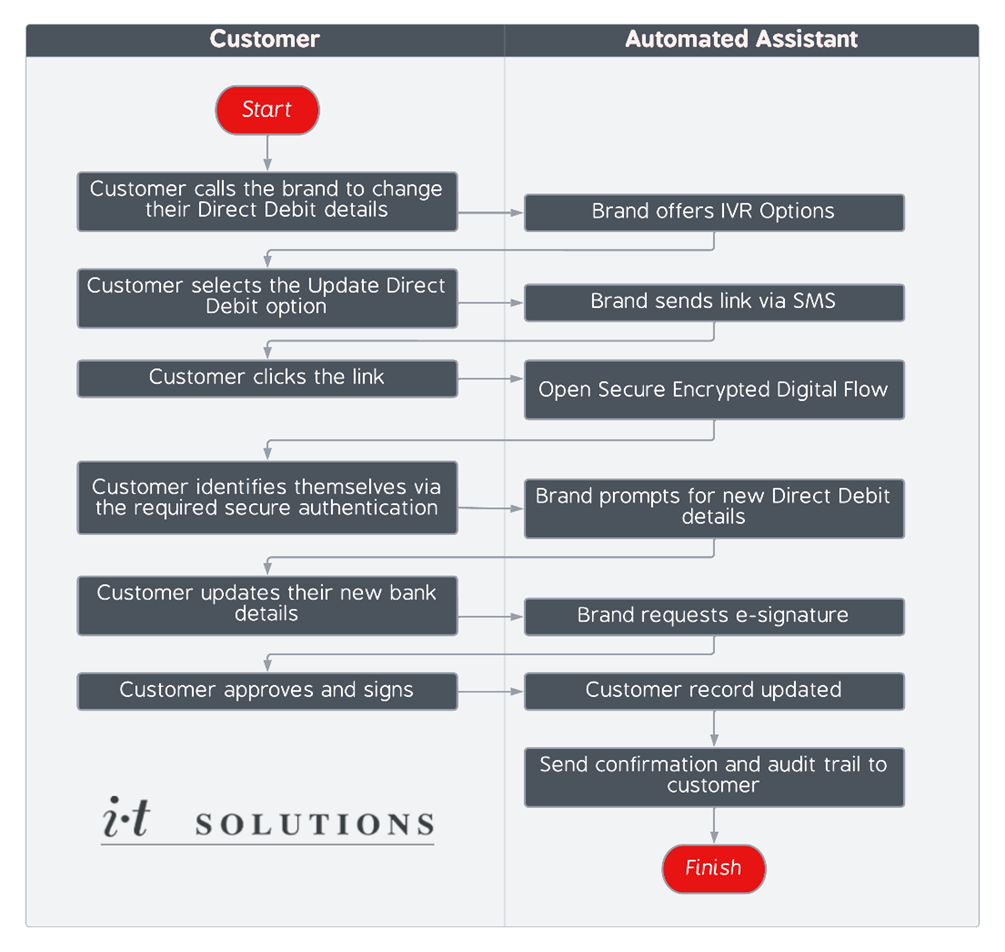

The diagram below highlights the workflow steps in the process. These steps may vary by individual brand.

In the example below, a customer must switch from their existing KBC or Ulster bank account to another financial institution. Then they must provide their new banking details to their brand (utility, telco, insurer, lender) to ensure their recurring monthly fees are debited correctly and paid on time.

Using the IT Solutions/Lightico secure cloud solution, the customer just needs to phone an automated service saving them considerable time, saving the brand time and cost, while also making the customer experience a lot more pleasurable.

- Customer makes a call to the brand (direct debit originator)

- to provide the brand with their new banking details

- so the brand can take future payments for recurring invoices using the new banking details.

- Brand’s IVR voice option lets the customer select an “Update Direct Debit” service.

- A branded link is provided to the customer via SMS at the customer’s request.

- Once the customer clicks on the link, a secure, encrypted form is presented, so that they can be authenticated on their mobile phone.

- The customer then updates their new bank details (IBAN) which can be validated for correct format etc.

- The customer electronically approves and signs the form on their mobile phone.

- The customer record is updated by the brand.

- The customer receives a confirmation including audit trail.

IT Solutions has been providing financial services solutions and contact centre solutions in Ireland for over three decades.

Lightico’s next-generation digital completion platform supports millions of banking, insurance, and telecom interactions and their multi-layered security infrastructure has made Lightico a trusted technology partner for the world’s largest and most demanding companies.

For more information contact IT Solutions to discuss how we can help you.